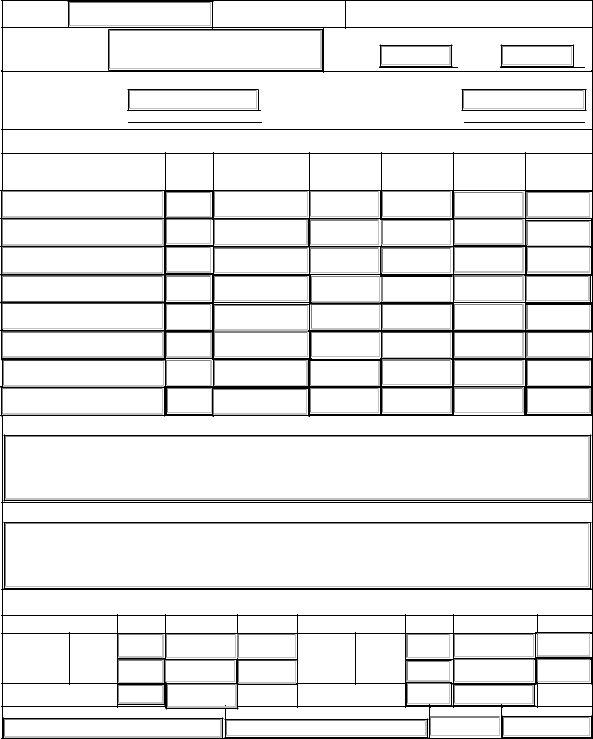

Form 204

Form 204 - Web arizonans may use state form 204 for an extension but don't need to submit this if filing a federal extension request with the irs. Chapter 11 or chapter 9 cases: Learn how to fill out the form, when to file it, and how to pay your tax liability. It contains information such as payee name, entity. Web arizona form 204 is used to apply for an automatic extension to file an individual income tax return. Web if you are a u.s.

Web a payee data record (std 204) is required for each vendor conducting business with or receiving payment from the state of california. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Web the ics 204 is normally prepared by the resources unit, using guidance from the incident objectives (ics 202), operational planning worksheet (ics 215), and the operations. Web arizonans may use state form 204 for an extension but don't need to submit this if filing a federal extension request with the irs. Web purpose of form 204.

Web the ics 204 is normally prepared by the resources unit, using guidance from the incident objectives (ics 202), operational planning worksheet (ics 215), and the operations. Web if you are a u.s. Web a completed payee data record (std. Tax on certain types of income,. If too little is withheld, you will generally owe tax when. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr.

Web a completed payee data record (std. Web form 204 is a document for forming a professional entity in texas that provides a specific professional service, such as medicine, law, or psychology. It contains information such as payee name, entity.

Employer's Quarterly Federal Tax Return.

Web arizonans may use state form 204 for an extension but don't need to submit this if filing a federal extension request with the irs. Web if you are a u.s. Web purpose of form 204. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who.

Resident Alien Who Is Relying On An Exception Contained In The Saving Clause Of A Tax Treaty To Claim An Exemption From U.s.

If too little is withheld, you will generally owe tax when. Web std.204 is a form for reporting payments to individuals or entities that are not governmental entities. Learn how to file, pay, and check the status of your extension online or by mail. Web the ics 204 is normally prepared by the resources unit, using guidance from the incident objectives (ics 202), operational planning worksheet (ics 215), and the operations.

Web A Payee Data Record (Std 204) Is Required For Each Vendor Conducting Business With Or Receiving Payment From The State Of California.

Web prepare an appeal bundle for the court of appeal (form 204) find out how to organise your documents (‘bundle’) in the standard way so that a judge can understand. Tax on certain types of income,. Web form 204 is a document for forming a professional entity in texas that provides a specific professional service, such as medicine, law, or psychology. A list of creditors holding the 20.

204 Form Is To Obtain Payee Information For Income Tax Reporting And To Ensure Tax Compliance With Federal And State Law.

Chapter 11 or chapter 9 cases: It contains information such as payee name, entity. Web arizona form 204 is used to apply for an automatic extension to file an individual income tax return. Web use form std 205, payee data record supplement to provide a remittance address if different from the mailing address for information returns, or make subsequent changes.